The original post can be found here. By Mikhail Kirilin

It’s no secret that artificial intelligence is changing the world as we know it. AI shows us what’s possible, from autonomous vehicles to predicting the weather. So it should come as no surprise that AI is also shaking up the stock market.

As the International Investment notes, one of the most promising examples of how AI is disrupting traditional finance is the way commodities are traded. These are some of the oldest forms of commerce and trading in the world. They are also an important part of a portfolio’s diversification.

Conventional wisdom held that investing in commodities was not for the average investor due to the complexity involved. However, with the rise of AI and machine learning, investors are now able to benefit from the increasing number of options available to them.

By using algorithms that can learn from past data, machine learning can provide predictions for future stock prices. Traders can use this information to make more informed decisions about where to invest their money.

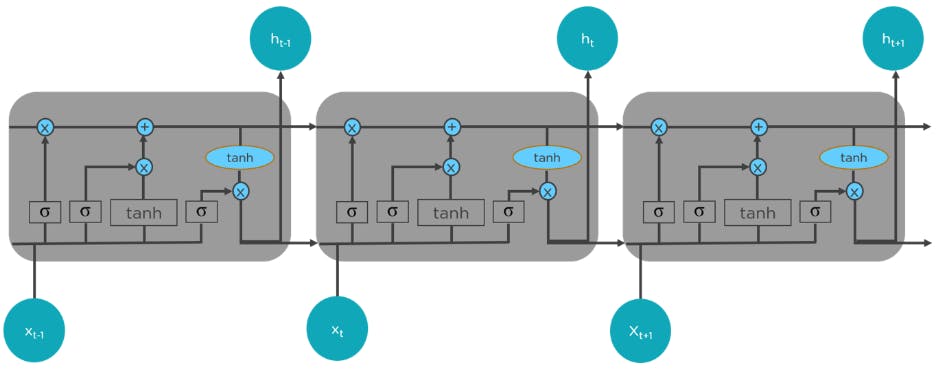

An example of a Long Short Term Memory Network (LSTM) for building your model to predict the stock prices of Google — by simplilearn.com

What is machine learning, and how can it be used to predict the stock market?

Machine learning is a type of artificial intelligence that focuses on creating algorithms that can learn and improve on their own. It is mainly used in predictive applications, such as stock market prediction. This means that machine learning can create models that can predict future events, trends, and patterns.

Machine learning is a powerful tool for stock market prediction. By analyzing historical data, machine learning algorithms can identify patterns that may indicate how the market will move in the future. This information can be used to make better investment decisions and generate profits.

Predictive applications based on MQL5 Language

MQL5 is a powerful programming language designed for developing trading strategies. It has a wide range of features that makes it ideal for machine learning and predictive modeling. In particular, MQL5 is very efficient in handling large data sets and performing complex calculations. This makes it well suited for stock market prediction applications.

There have been many successful applications of MQL5 in stock market prediction. One notable example is the Stock Market Prediction application developed by Hamidreza Ghaffari & Maziyar Taharozi. This system uses MQL5 to predict stock prices on the Iranian stock market.

Also, MQL5.com is a source for starting an algorithmic trading journey due to its range of useful tools and features. One can start discovering this trading community by looking into the Market of ready-made stock forecast solutions or meeting individual investors if there’s a need for custom development.

The history of machine learning and its successes in predicting the stock market.

The use of machine learning in stock market prediction has been successful in many cases. In 2006, for example, a group of computer science researchers at Stanford University used machine learning to develop a system that could predict the direction of the Dow Jones Industrial Average with an accuracy of 86%. The system was able to achieve this accuracy by analyzing past stock prices and identifying patterns that could be used to predict future movements.

__Jingyi Shen from Carleton University used Long Short-term Memory (LSTM)model to__retain the features’ time dependency and achieves 96%, significantly high accuracy in predicting price-up trends and a 93.25% overall prediction accuracy.

Machine learning is also being used by hedge funds and other financial institutions to predict the stock market. In 2020, for example, Volt Capital Management AB, a Swedish hedge fund, outperformed its expectations by a 14% return on investment with the help of artificial intelligence.

The success of machine learning in stock market prediction is likely to continue in the future as more data becomes available and computing power increases. Machine learning will become even more critical as we move into an era where automated trading systems are becoming increasingly common.

The black box problem

AI models are often criticized for being black boxes, which means they have no visibility into how their inputs are combined to produce output. This is the main reason why acceptance rates are not as high as they can be. Despite being labeled as black boxes, these models are still widely used in various industries, such as e-commerce.

How not to get into the black box trouble

Shivam Sinha shared a few pieces of advice for everyone who plans to utilize ML in their trading. According to her, aside from having the necessary skills to use both finance and ML, it is also important to have the necessary experience with both. The first step is to identify the drivers that are most important to market participants.

- Before using financial market data, ML models should first break it down into its various economic regimes. These are the types of data that are used to measure asset performance.

- The relationship between market data and the drivers of asset performance should not be based on statistical data. Instead, it should be driven by economic intuition.

- Benchmark: Always validate whether ML models are adding value over linear models.

- One of the most important steps in building a model is to get rid of the garbage. For instance, if a model is sensitive to outliers, then they should be removed before the data is fed.

- Before building a model, it’s also important to determine the minimum amount of data that the model should have.

- One should also keep an open mind when it comes to running a model. If it’s already overfitting, then it should stop.

Before the advent of machine learning, forecasting the stock market was a time-consuming process. Today, with the use of these models, it has become easier than ever to predict the market. Despite the progress that technology has made, it still has a long way to go before it can fully replace humans. However, if you need to use ML models, don’t be afraid to try them.

Never Miss an Update

Get notified when we publish new analysis on HFT, market microstructure, and electronic trading infrastructure. No spam.

Subscribe by EmailI help financial institutions architect high-frequency trading systems that are fast, stable, and profitable.

I have operated on both the Buy Side and Sell Side, spanning traditional asset classes and the fragmented, 24/7 world of Digital Assets.

I lead technical teams to optimize low-latency infrastructure and execution quality. I understand the friction between quantitative research and software engineering, and I know how to resolve it.

Core Competencies:

▬ Strategic Architecture: Aligning trading platforms with P&L objectives.

▬ Microstructure Analytics: Founder of VisualHFT; expert in L1/L2/LOB data visualization.

▬ System Governance: Establishing "Zero-Failover" protocols and compliant frameworks for regulated environments.

I am the author of the industry reference "C++ High Performance for Financial Systems".

Today, I advise leadership teams on how to turn their trading technology into a competitive advantage.

Key Expertise:

▬ Electronic Trading Architecture (Equities, FX, Derivatives, Crypto)

▬ Low Latency Strategy & C++ Optimization | .NET & C# ultra low latency environments.

▬ Execution Quality & Microstructure Analytics

If my profile fits what your team is working on, you can connect through the proper channel.