To anyone paying attention, or just reading the latest musings from Michael Lewis, the one consistent way to make money in the stock market is to do so at an incredibly high frequency.

In its IPO filing in 2014, Virtu Financial said it had exactly one day of trading losses in 1,238 days. That kind of consistent profitability seems to be still the case: a new study from a team at Princeton University found that predictability in high frequency trading returns and durations is “large, systemic and pervasive”.

They focused on the period from Jan. 2019 to Dec. 2020, which includes the turmoil when the coronavirus pandemic first hit the western world. With what they said was minimal algorithmic tuning, they can get to 64% accuracy for predicting the direction of the next trade over the next five seconds.

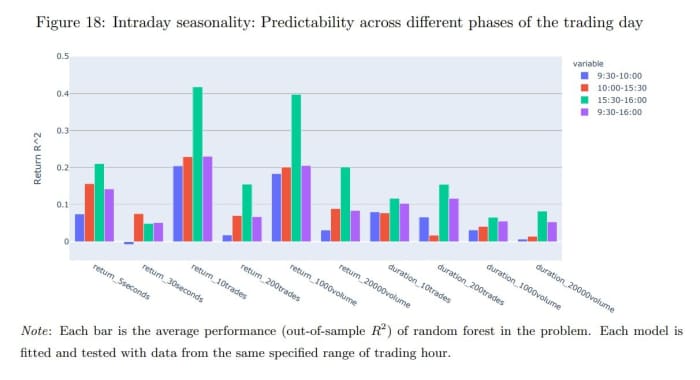

Returns and trade direction are even more predictable for stocks with lower prices, and are less liquid, volatile and correlated with the aggregate market. And the end-of-the-day period is particularly predictable. That said, the length of this predictability is small — in just five minutes, or approximately 2,000 transactions, the predictability of returns vanishes to zero, they find.

The most predictable period of the day for HFT firms is the 3:30-4 p.m. Eastern time period.

Princeton researchers

One interesting finding is introducing a small artificial delay in processing the data decreases the accuracy of predictions, a finding that seems to support the speed bump idea popularized by the IEX stock exchange.

The Princeton researchers also simulated the effect that acquiring some signal on the direction of the order flow would have for the accuracy of the predictions. The idea is that knowledge could be gained by looking at order flow at different exchanges. That would boost the return predictability from 14% to 27%, and price direction accuracy from 68% to 79%. “Whether it is realistic or not to endow some high frequency traders with such an ability, it is clearly valuable,” they find.

The Princeton paper, whose lead author is Yacine Aït-Sahalia, was circulated by the National Bureau of Economic Research.

Never Miss an Update

Get notified when we publish new analysis on HFT, market microstructure, and electronic trading infrastructure. No spam.

Subscribe by EmailI help financial institutions architect high-frequency trading systems that are fast, stable, and profitable.

I have operated on both the Buy Side and Sell Side, spanning traditional asset classes and the fragmented, 24/7 world of Digital Assets.

I lead technical teams to optimize low-latency infrastructure and execution quality. I understand the friction between quantitative research and software engineering, and I know how to resolve it.

Core Competencies:

▬ Strategic Architecture: Aligning trading platforms with P&L objectives.

▬ Microstructure Analytics: Founder of VisualHFT; expert in L1/L2/LOB data visualization.

▬ System Governance: Establishing "Zero-Failover" protocols and compliant frameworks for regulated environments.

I am the author of the industry reference "C++ High Performance for Financial Systems".

Today, I advise leadership teams on how to turn their trading technology into a competitive advantage.

Key Expertise:

▬ Electronic Trading Architecture (Equities, FX, Derivatives, Crypto)

▬ Low Latency Strategy & C++ Optimization | .NET & C# ultra low latency environments.

▬ Execution Quality & Microstructure Analytics

If my profile fits what your team is working on, you can connect through the proper channel.