Back in February, I was working in a trading platform for a high-speed shop. We were working for more than 8 months until we hit such a great returns.

After several months, I had permission to share (anonymously) what 2 hours of a real high-performance trading looks like. And wanted to share this post to give an idea of what kind of trades and how fast/frequent they are.

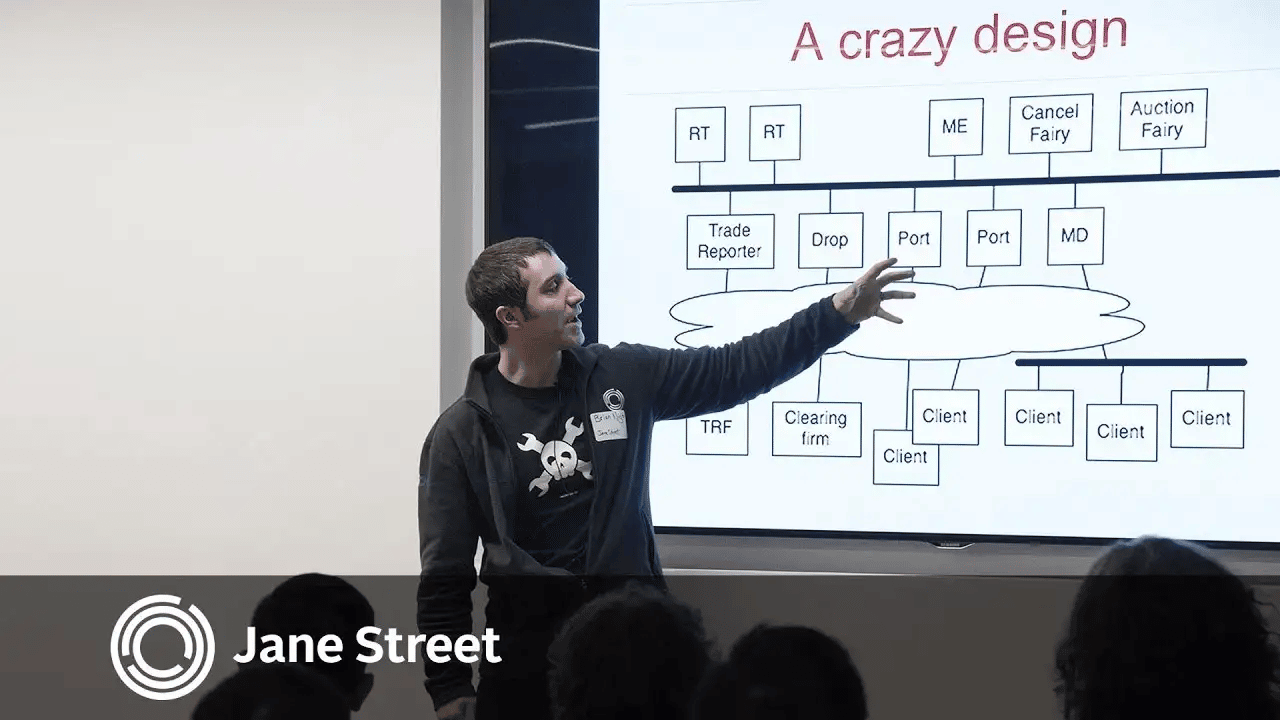

The platform was created from scratch, using lightweight C++ code. I was especially focused on the architecture of the software, something crucial to achieving high-speed processing. After platform was done, was the turn of creating, testing and adjusting the strategy.

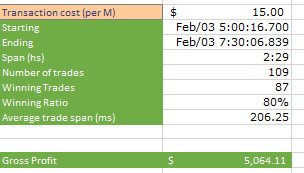

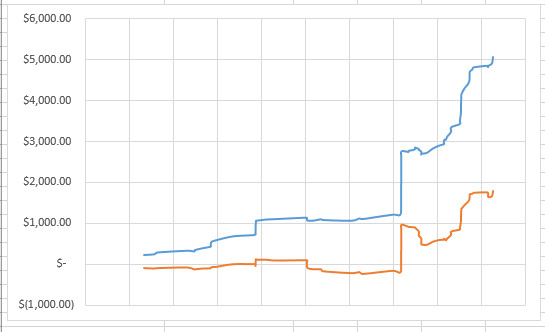

The result is a system with excellent returns on the forex market. And by the chart below you can see by how much.

Several things to look at:

· Winning ratio is 80% (at least in these 2 hours)

· A total of 109 trades has been made over this period

· Average trade, last 206 milliseconds

· Note how transaction cost affect the system

o Blue line is without cost

o Orange accounting transaction cost

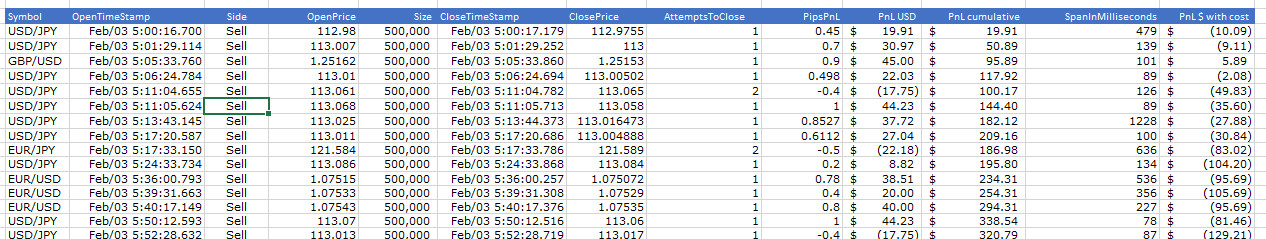

· Attempts to close means how many times we tried to flat our position but couldn’t (because of execution, or price movement). Every time there is more than one attempt, the trade is a losing trade. So, that’s the proof of how important execution quality and speed is.

Summary of the collected trades

Equity curve, with and without trading costs

The actual trades

You can find the excel sheet showing all this at this link http://www.slideshare.net/silahian/what-2hs-of-a-real-hft-trading-system-looks-like

Conclusion, execution speed is priority number 1, then the quality of execution and last liquidity.

ENJOY! And Share if you like it!

Ariel Silahian

http://www.sisSoftwareFactory.com/quant

https://twitter.com/sisSoftware

Keywords: #hft #quants #forex #fx #risk $EURUSD $EURGBP $EURJPY

Never Miss an Update

Get notified when we publish new analysis on HFT, market microstructure, and electronic trading infrastructure. No spam.

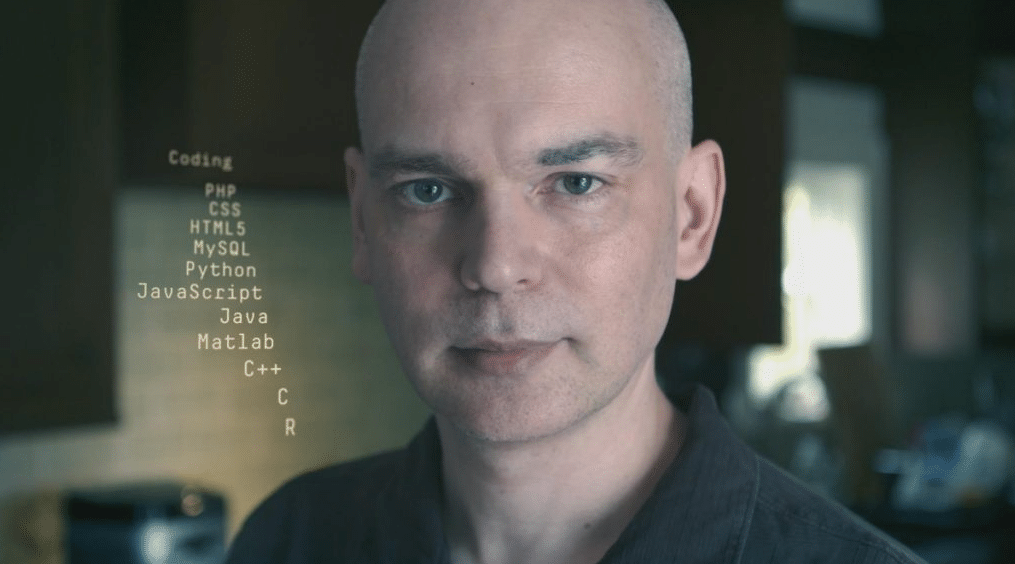

Subscribe by EmailHFT Systems Architect & Consultant | 20+ years architecting high-frequency trading systems. Author of "Trading Systems Performance Unleashed" (Packt, 2024). Creator of VisualHFT.

I help financial institutions architect high-frequency trading systems that are fast, stable, and profitable.

I have operated on both the Buy Side and Sell Side, spanning traditional asset classes and the fragmented, 24/7 world of Digital Assets.

I lead technical teams to optimize low-latency infrastructure and execution quality. I understand the friction between quantitative research and software engineering, and I know how to resolve it.

Core Competencies:

▬ Strategic Architecture: Aligning trading platforms with P&L objectives.

▬ Microstructure Analytics: Founder of VisualHFT; expert in L1/L2/LOB data visualization.

▬ System Governance: Establishing "Zero-Failover" protocols and compliant frameworks for regulated environments.

I am the author of the industry reference "C++ High Performance for Financial Systems".

Today, I advise leadership teams on how to turn their trading technology into a competitive advantage.

Key Expertise:

▬ Electronic Trading Architecture (Equities, FX, Derivatives, Crypto)

▬ Low Latency Strategy & C++ Optimization | .NET & C# ultra low latency environments.

▬ Execution Quality & Microstructure Analytics

If my profile fits what your team is working on, you can connect through the proper channel.