Using Monte Carlo Simulation for Algorithmic Trading

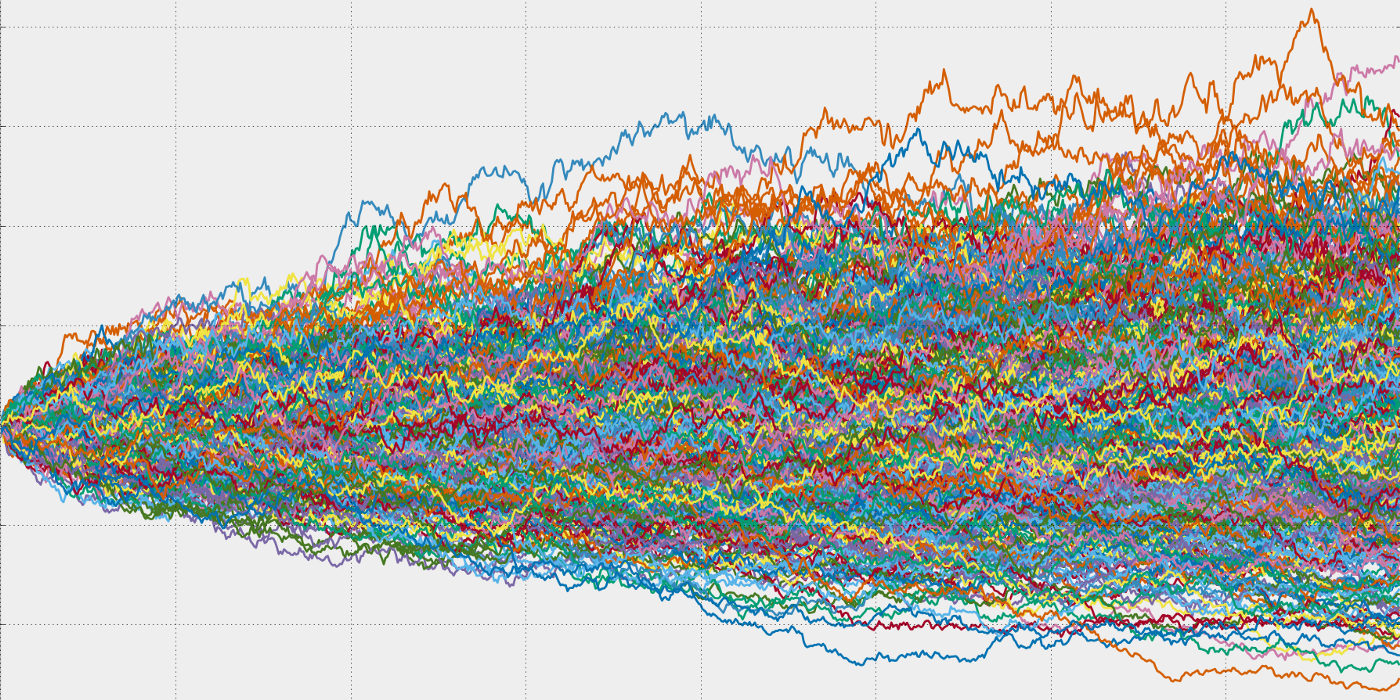

In financial markets, quantitative traders use the most common Monte Carlo Simulation method to reshuffle the order of their historical trades to help them better understand how a trading system could have happened.