Algorithmic trading, often referred to as algo trading, involves using computer programs to follow a defined set of instructions for placing trades. The primary objective is to achieve specific returns by automating the trading process, eliminating the time delay and human error. The rise of algorithmic trading has transformed financial markets, offering precision, speed, and the potential for profit. However, with these advantages come challenges that traders need to understand.

Table of Contents

- The Limit Order Book (LOB) and Its Role in Trading

- Adverse Selection in Algorithmic Trading

- Positioning in the LOB

- Understanding Slippages in Trades

- Order Cancellations and Rejections: The Role of Liquidity Providers

- Trading Venues and Their Influence on Trades

- Visualization and Real-time Monitoring in Trading

- The Open-Source Revolution: VisualHFT

- Conclusion

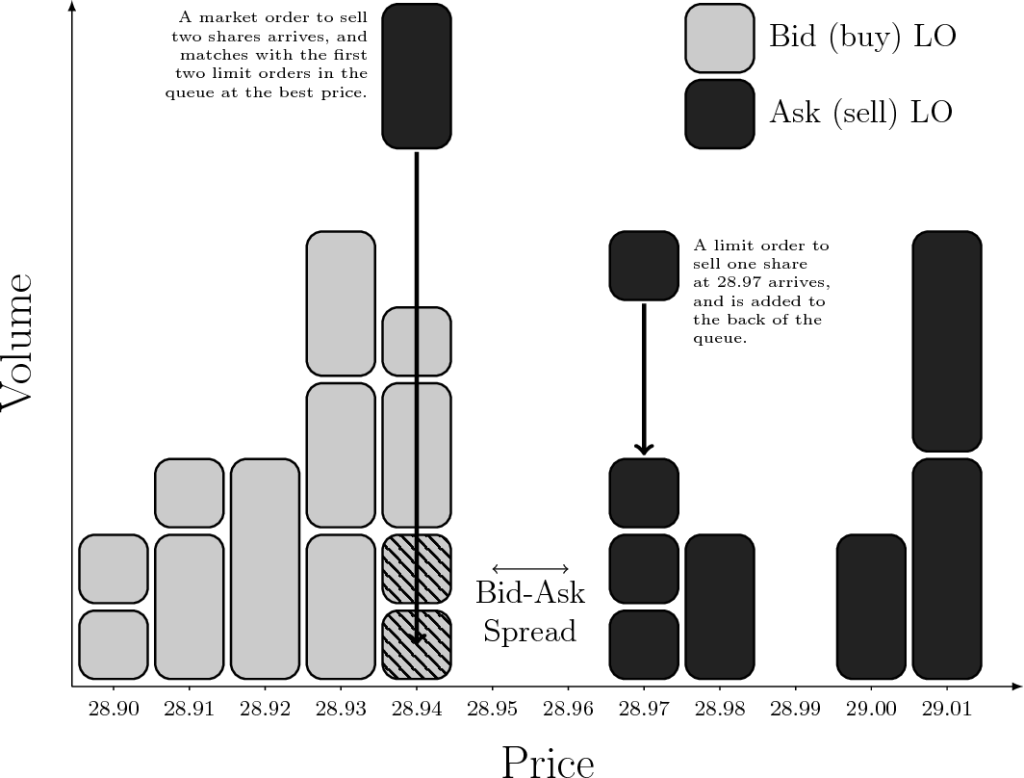

The Limit Order Book (LOB) and Its Role in Trading

The LOB is a fundamental component of most trading venues. It’s a real-time, continually updated list of buy and sell orders in a particular market. Each order shows the price and quantity, and the LOB is organized by price level.

- Definition and function of the LOB:

The LOB provides a transparent view of the demand and supply for a specific security at different price levels. It allows traders to see where the market is moving, where liquidity is pooled, and where potential price resistance points might occur. - Structure of the LOB and its tiers:

The LOB is divided into price levels. The highest price someone is willing to pay for a security (the highest bid) and the lowest price someone is willing to sell it for (the lowest ask) are at the top. As you move down the book, bid prices decrease, and ask prices increase. - Implications of order positioning within the LOB:

The position of an order in the LOB can determine how quickly it gets filled. Orders at the top of the book are the first to be executed. If a trader’s order is buried deep in the book, it might not get executed unless there’s a significant market move. - Case study: Consider a trader who places a buy order for a stock at $100. If the LOB has large sell orders at $101 and few buy orders above $100, the trader’s order might be far down in the book, reducing its chances of execution.

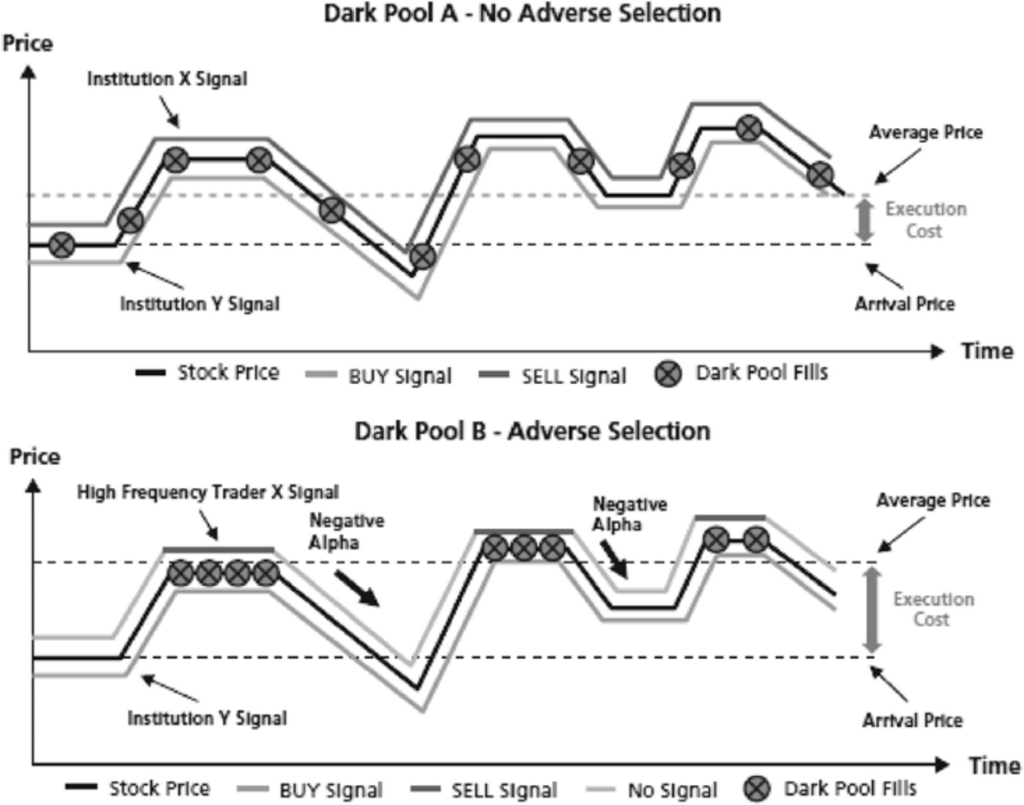

Adverse Selection in Algorithmic Trading

Adverse selection is a concept where one party in a transaction has more information than the other. In trading, this can lead to significant costs for uninformed traders.

- Definition of adverse selection:

In the context of trading, adverse selection occurs when a trader’s order is executed against another order that has better information. This typically results in the informed trader profiting at the expense of the uninformed trader. - Mechanisms leading to adverse selection in trading:

Traders with advanced algorithms, faster data feeds, or insider information can anticipate market moves better than others. When less informed traders place orders, they might be unknowingly trading against these informed traders. - Strategies to identify and counteract adverse selection:

- Use of post-trade analysis to identify patterns of adverse selection.

- Employing algorithms that break up orders to minimize visibility.

- Avoiding trading during times of high volatility when adverse selection is more prevalent.

- Case study: A trader using a basic algorithm might notice that their orders frequently result in immediate unfavorable price moves. Upon analysis, they realize they’re consistently trading against a high-frequency trading firm with faster data feeds, leading to adverse selection.

Positioning in the LOB

The position of an order within the LOB can significantly influence the likelihood of its execution. Being closer to the top means the order is more likely to be filled, but achieving and maintaining this position can be challenging.

- Importance of the position within the LOB:

The closer an order is to the top of the LOB, the higher its priority. This means it’s more likely to be executed before orders at lower levels. For traders, understanding where their order sits can be crucial for strategy execution. - Factors determining position in the LOB:

Several factors can influence an order’s position:

- Price: Orders with better prices (higher bids or lower asks) are prioritized.

- Time: Among orders with the same price, the one placed earlier gets priority.

- Order type: Some order types, like market orders, are executed immediately, while others, like limit orders, wait for a specific price.

- Tools and strategies to optimize positioning:

- Monitoring tools that provide real-time feedback on order position.

- Algorithms that adjust order price based on market movement.

- Using iceberg orders that display only a portion of the total order, keeping the rest hidden.

- Case study: A trader aiming to buy a large quantity of shares might use an iceberg order. By showing only a small portion of the total order, they avoid influencing market perception while still maintaining a favorable position in the LOB.

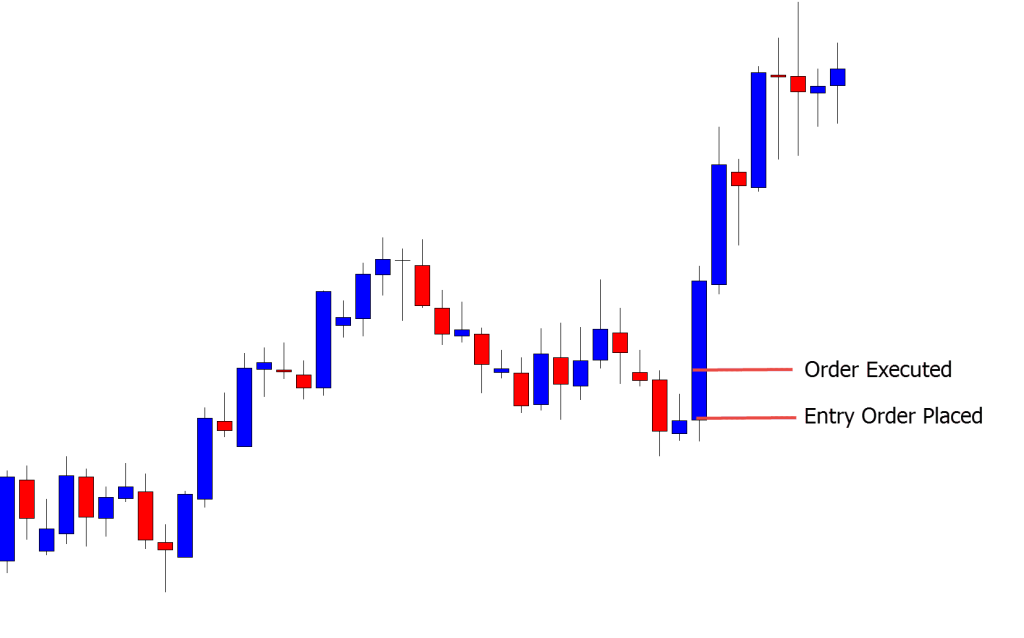

Understanding Slippages in Trades

Slippage is a common occurrence in trading and refers to the difference between the expected price of a trade and the price at which it’s executed.

- Definition of slippage:

Slippage occurs when market orders are executed at a different price than expected. It can be favorable (better than expected) or unfavorable (worse than expected). - Factors leading to slippage in trades:

- Market volatility: Rapid price movements can cause slippage.

- Order size: Large orders might not be fully executed at the desired price.

- Market liquidity: In illiquid markets, orders might not find a match immediately.

- Impact of slippage on trading outcomes:

While occasional slippage is a part of trading, consistent unfavorable slippage can erode profits. It’s essential for traders to monitor and manage slippage to ensure optimal trading outcomes. - Strategies to minimize slippage:

- Using limit orders that specify a maximum or minimum execution price.

- Avoiding trading during major news events that can cause volatility.

- Employing algorithms that adjust trading strategy based on market conditions.

- Case study: During a major economic announcement, a trader places a market order to sell a stock. Due to the sudden surge in volatility, the order gets executed at a price significantly lower than expected, leading to a larger than anticipated loss.

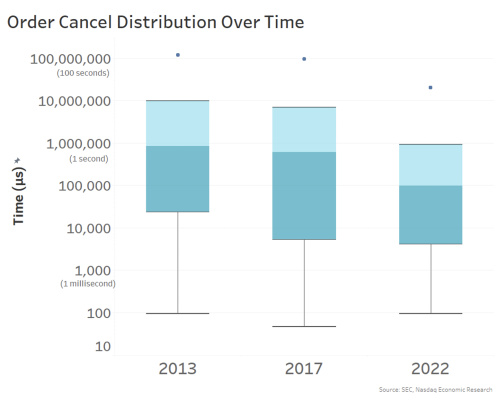

Order Cancellations and Rejections: The Role of Liquidity Providers

Liquidity providers play a pivotal role in modern trading ecosystems. They offer buy and sell orders to the market, ensuring that traders can execute their trades even in less liquid markets. However, their operations can also lead to order cancellations.

- Liquidity Providers and Their Function:

Liquidity providers, often institutions or algorithmic traders, supply the market with buy and sell orders. Their primary goal is to earn the bid-ask spread by fulfilling both sides of trades. - Reasons for Order Cancellations by Liquidity Providers:

- Market Conditions: Liquidity providers might cancel orders if they perceive a significant risk due to rapid market movements.

- Risk Management: Orders might be canceled to manage exposure and ensure that they don’t exceed risk thresholds.

- Inventory Management: If a liquidity provider accumulates too much of an asset, they might cancel orders to avoid further accumulation.

- Algorithmic Strategies: Automated strategies might cancel orders based on a variety of factors, including market depth, volatility, or other algorithmic conditions.

- Implications of Liquidity Provider Cancellations:

- Reduced Market Depth: Frequent cancellations can reduce the depth of the order book, leading to potential slippage for other traders.

- Increased Market Volatility: Rapid order cancellations can cause short-term volatility, especially in less liquid markets.

- Trust and Reliability Concerns: Traders might perceive a venue as less reliable if liquidity providers frequently cancel orders.

- Strategies to Minimize the Impact of Liquidity Provider Cancellations:

- Diversified Trading: Traders can diversify their trades across multiple venues to reduce the impact of cancellations on any single platform.

- Advanced Order Types: Using order types like fill-or-kill can ensure that an order is either fully executed or canceled, reducing partial fills that can occur due to liquidity provider cancellations.

- Monitoring Tools: Traders can use tools to monitor liquidity provider behavior and adjust their strategies accordingly.

- Case study: In a particular trading venue, traders notice an increase in order cancellations during high volatility periods. Upon investigation, it’s found that a major liquidity provider’s algorithm was designed to reduce exposure during such times, leading to frequent order cancellations. The venue then engages with the provider to ensure more consistent order fulfillment, benefiting all participants.

Trading Venues and Their Influence on Trades

Trading venues are platforms or places where buyers and sellers come together to trade financial instruments. The choice of trading venue can have a direct impact on the efficiency, cost, and success of trading activities.

- Different Types of Trading Venues:

- Stock Exchanges: Traditional platforms like NYSE or NASDAQ where securities are bought and sold.

- Electronic Communication Networks (ECNs): Digital platforms that automatically match buy and sell orders.

- Dark Pools: Private exchanges where participants trade without displaying their order book to the public.

- Role of Trading Venues in Trade Execution:

- Order Matching: Venues use specific algorithms to match buy and sell orders.

- Price Determination: The price of securities is determined based on the orders present in the venue’s system.

- Trade Settlement: After a trade is executed, the venue oversees the transfer of securities and funds between trading parties.

- Factors Influencing Choice of Trading Venue:

- Liquidity: Venues with more participants usually offer better chances of order execution.

- Cost: Different venues have varied fee structures, which can influence the overall cost of trading.

- Speed: The time it takes for orders to be executed can vary between venues.

- Regulatory Environment: Some venues operate under stricter regulatory oversight, ensuring transparency and fairness.

- Impact of Trading Venue on Strategy Effectiveness:

The choice of trading venue can influence the effectiveness of a trading strategy. For instance, a strategy that relies on quick execution might be better suited to a high-speed ECN than a traditional stock exchange. - Case Study: A trader decides to execute a large order in a dark pool to avoid influencing the market price. However, due to the lower liquidity in the dark pool compared to a public exchange, the order takes longer to fill, leading the trader to reconsider the choice of venue for future large trades.

Visualization and Real-time Monitoring in Trading

In the digital age of trading, having access to real-time data and the ability to visualize this data can make a significant difference in trading decisions.

- Importance of Real-time Data in Trading:

Real-time data provides traders with up-to-the-second information on market movements, order book depth, and other vital metrics. This immediacy allows for quick decision-making and adjustments to trading strategies. - Tools Available for Real-time Monitoring:

Various platforms and software offer real-time monitoring capabilities. These tools can display live charts, order book depth, recent trades, and more. Some advanced tools also provide algorithmic analysis and predictive modeling based on real-time data. - Benefits of Visualization in Understanding Trade Data:

Visualization tools transform raw data into charts, graphs, and other visual formats. This transformation makes it easier to spot trends, understand market depth, and analyze trading patterns. Visualization can also help in identifying anomalies or irregularities in trading data. - Introduction to VisualHFT:

VisualHFT is a tool designed to offer insights into trading data through visualization. It provides real-time monitoring capabilities, allowing traders to see hidden information and monitor activities as they happen. As an open-source project, it invites contributions from the trading community, ensuring continuous improvement and adaptation to the evolving needs of traders.

The Open-Source Revolution: VisualHFT

Open-source tools have transformed various industries, and trading is no exception. These tools are developed collaboratively, with input from a global community, ensuring they remain cutting-edge and relevant.

- Overview of Open-source Tools in Trading:

Open-source tools in trading range from algorithmic strategy development platforms to data analysis and visualization tools. These tools are freely available, allowing traders to customize and adapt them to their specific needs. - Benefits of Using Open-source Tools:

- Cost-effective: No licensing fees.

- Customizable: Traders can modify the tool to suit their requirements.

- Community Support: A global community of developers and traders provides support, updates, and new features.

- Community Contributions and the Evolution of VisualHFT:

Being open-source, VisualHFT benefits from contributions from traders, developers, and experts worldwide. This collaborative approach ensures that the tool remains updated with the latest features and is optimized for the current trading landscape. - Case study: A group of traders identified a specific need for better visualization of high-frequency trading data. Using VisualHFT’s open-source code, they developed a new feature that provided insights into microsecond-level trades. This feature was then integrated into the main VisualHFT platform, benefiting the broader trading community.

Conclusion

Understanding the intricacies of algorithmic trading is essential for traders in today’s digital age. From the significance of the Limit Order Book to the influence of trading venues, each aspect plays a crucial role in trading outcomes. Tools like VisualHFT offer insights and real-time monitoring capabilities, highlighting the importance of staying informed and adapting to the evolving landscape. As trading continues to advance, embracing these insights and tools will be vital for success in the market.